Brick-and-mortar businesses deserve a break. The past few years have brought one hurdle after the next, with the rise of e-commerce, pandemic-forced shutdowns and escalating operating costs. In fact, some of the most iconic businesses have fallen into bankruptcy.

Business owners who found innovative ways to stay afloat in the post-COVID era face even more challenges in 2023 as supply chain issues linger and our economy teeters on the edge of a recession.

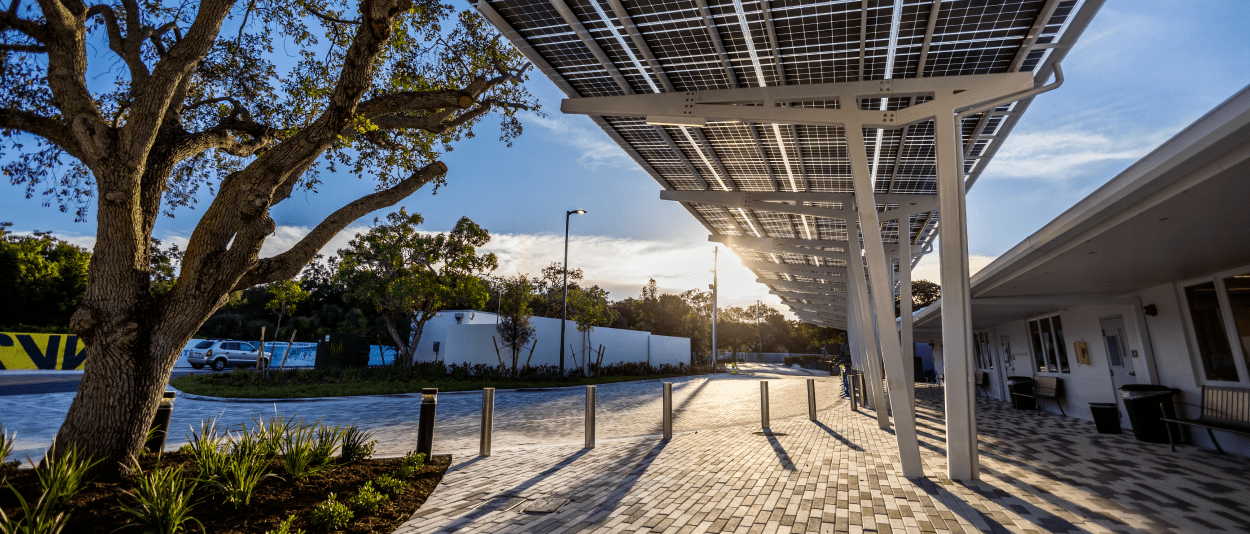

In search of ways to remain profitable, many companies are looking toward the sun.

Solar panels for business owners enable savvy leaders to focus on factors within their control, and bolster their company’s resilience to outside forces.

How Can Commercial Solar Benefit my Business?

Regardless of the size or sector, no business, school, nonprofit or government entity is immune to market uncertainty. Whether you’re a public university or a boutique vineyard, slow economic growth is sure to impact the way your business operates.

From a general business standpoint, cutting overhead expenses may help prevent layoffs and the need to increase prices.

Here are three ways solar panels for business owners can harness the power of sunshine to improve their bottom line.

1. Reduce Business Expenses

The day your commercial solar panels start producing energy is the day the sun will begin lowering your overhead costs. Aside from labor, your property costs and utilities are typically the biggest expenses. While your rent or mortgage is fixed, your utility costs are variable. Therefore, it can be difficult to predict your commercial electricity bill, especially if you experience extreme weather or your rates have recently changed.

By drawing less electricity from your utility during the day, you can use the sun’s abundant energy to reduce your overhead expenses — from running electric heat and AC to powering industrial and commercial equipment, lights and breakroom appliances.

As for the guesswork, solar panels for business owners allow you to take greater control of your energy costs with predictable solar payments. Whether you pay for your system upfront or know exactly what your solar costs will be each month, you can plan for other expenses with greater certainty. The more accurate your financial planning and cash flow projections are, the better your business can stay on track during periods of growth and unexpected challenges.

Want to learn more about how solar can help reduce your operating costs?

2. Achieve Your ESG Goals

ESG, which stands for “environmental, social and governance,” helps stakeholders understand how a company manages its risk and opportunities in regard to sustainability issues.

Ironically, these non-financial factors can have a significant financial impact. By identifying material risks and growth opportunities, socially conscious investors use ESG standards to screen investments. And the interest in well-managed, sustainably minded companies has never been higher.

The ESG framework evaluates a company’s commitment to:

- Reducing its carbon emissions

- Managing its financial risk

- Holding itself accountable

As a business leader, adopting on-site renewable energy is one of the simplest, most cost-effective measures you can take to help meet your company’s ESG goals. Solar panels for business owners demonstrate a company’s commitment to reducing greenhouse gases, while helping diversify its energy mix and mitigate volatile electricity prices for two decades or longer.

By installing solar and committing to ESG goals, business owners demonstrate goodwill and long-term dedication to environmental stewardship for all stakeholders — employees, customers and society as a whole. And, according to McKinsey, a strong ESG proposition can safeguard a company’s long-term success, leading to higher equity returns and a reduction in downside risk.*

Find out how your solar project can bring you closer to your ESG goals.

3. Tax Credits and Write-Offs

Keep in mind that solar for business owners is an investment — a long-term investment. Fortunately, there are incentives and depreciation benefits to help minimize the up-front costs.

If you buy your system with cash or opt for a loan (and your tax appetite is large enough), you may be able to claim tax credits and rebates: most notably, the solar investment tax credit (ITC). While Sunnova makes no guarantees on the eligibility of your system, you may qualify for a tax break on your total installed costs. The ITC is a federal incentive that was set to decline to 10% for commercial solar in 2024, but was increased to 30% and extended through 2034, thanks to the passing of the Inflation Reduction Act.*

In some cases, solar panels for businesses may qualify for bonus credits (also called adders) that increase your percentage of system cost that you can claim on your federal taxes.

Commercial projects may qualify for adders if they:*

- Are located in/on a brownfield site

- Utilize equipment that’s sourced domestically

- Are built in certain low-income areas

- Meet certain wage and apprenticeship requirements

In addition, any business that claims the solar ITC may be eligible for accelerated system depreciation. Using a Modified Accelerated Cost-Recovery System (MACRS), business owners can deduct a system's depreciation expenses from their taxes over five years, rather than the entire lifespan of a system.

If your business doesn’t have enough tax liability to take the 30% tax break in a single year, you may carry that credit backward three years and forward for 22 years to help reduce tax payments (in 2023 or later).*

By taking advantage of available incentives and tax deductions, you may be able to:

- Offset any potential upfront costs of going solar

- Shorten the timeline of your solar break-even point

- Start enjoying the return on your solar investment sooner

Unfortunately, organizations that don’t pay annual taxes cannot claim the ITC, such as schools, religious institutions and other exempt entities. At Sunnova, we are energy service experts, not tax experts. Please be sure to consult your tax advisor to better understand your eligibility.

What are You Waiting For?

If you’re a business owner looking to boost your bottom line, commercial solar could be the way. By installing solar on your rooftop, mounting your panels on the ground or building solar carports, you can harness clean energy from the sun and improve the way you do business.

From reducing operating expenses and lowering utility bills to attracting investors and pledging to protect the planet, your company can enjoy the perks of clean energy for up to 25 years or longer.

Gain greater budget certainty with predictable solar energy costs and increase your financial returns today — with solar for business owners.